Being an insurance advisor is a lucrative career opportunity. You can earn limitless commissions on the plans you sell and work at your convenience. However, becoming an advisor requires you to clear IC 38 exam. The insurance advisor exam is prescribed by the IRDAI (Insurance Regulatory and Development Authority of India) and individuals who clear it can get a license to act as an insurance advisor.

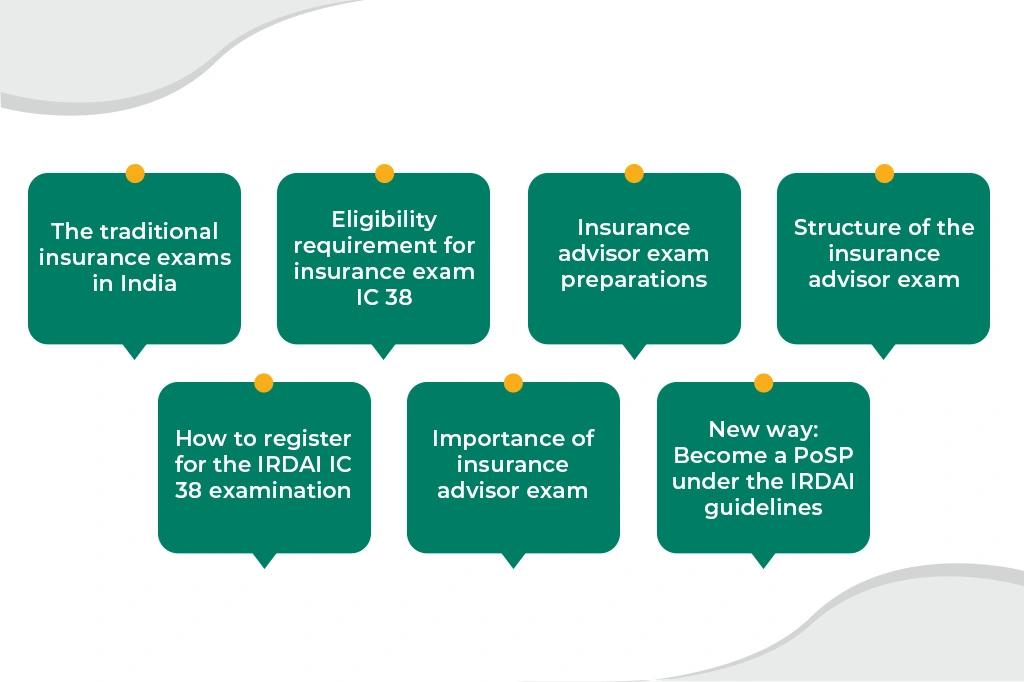

Insurance exams in India

In order to become an insurance advisor with the insurer directly, you need to clear the IC 38 examination. This is the traditional way to become an insurance advisor and then earn commissions for the policies sold. You can sell insurance policies of only that insurance company with which you are enrolled as an insurance advisor.

Let’s understand the details about this insurance advisor exam –

IC 38 Exam Eligibility Criteria

To apply for becoming an advisor and sit for the exam you should qualify on some eligibility parameters. Only if you meet the specified eligibility criteria can you appear for an insurance advisor’s exam and get your license. Here are the basic criteria required to be met –

- You should be at least 18 years old

- You should have passed Class 10 if you live in a rural area and Class 12 in case of an urban area

Insurance exam preparation

Preparations for the insurance advisor exam are simple. There is an IRDA certification course prescribed by the IRDAI. Training is provided by authorised institutions which equip you with the basic syllabus of the examination conducted. You understand the basics of insurance and its important concepts. As per the IRDAI prescribed insurance exam syllabus, you are taught the following –

- The concept of insurance, its need and purpose

- The important terms associated with insurance like risk, peril and hazard

- The insurance market and its channels

- The principles of insurance

- How to sell, etc.

If you take the training properly, understand the insurance concepts and arm yourself with the knowledge you get, your insurance exam preparations are done and you can easily clear the insurance advisor’s exam.

Read more about How to become an Insurance advisor.

Structure of IRDA exam for insurance advisor

The insurance advisor’s exam is conducted online. It is a 50-mark questionnaire containing multiple-choice questions. You have to score at least 40% marks to clear the examination and be eligible for an insurance advisor’s license.

Some of the sample IRDA exam questions which feature in the online insurance advisor exam are as follows –

- Who is entitled to receive the death benefit under a life insurance policy?

- Policyholder

- Nominee

- Any of the above

- None of the above

- Which is a pure protection insurance plan?

- Endowment plan

- ULIP

- Term insurance

- Money back plan

- In case of an investigation into the cause of death in a death claim, the company gets a maximum of —– to complete its investigation

- 3 years

- 6 months

- 1 year

- 10 months

- Premium can be loaded because of which of the following –

- Health risk

- Smoking habit

- Paying the premiums monthly

- All of the above

- Which of the following statements is true?

- Life insurance covers emotional loss

- Certain risks can be covered under insurance

- Training is required for insurance advisor’s exam

- An insurance advisor’s license is lifelong valid

- The MWP Act is aimed to protect the interests of –

- The wife

- The kids

- Both wife and kids

- None of the above

- —– is the basis of insurance

- Proposal form

- Policy bond

- Premium receipt

- All of the above

- What is revival of a policy?

- Restarting a policy after the end of the tenure

- Buying a new policy

- Restarting a lapsed policy

- None of the above

- An insurance advisor’s license is valid for

- 3 years

- 5 years

- 7 years

- 2 years

- Insurance policies designed for the rural population are called ——

- Rural insurance plans

- Micro insurance plans

- Group insurance plans

- None of the above

- A with-profit life insurance policy offers —–

- A fixed return

- Bonus additions

- Double death benefit

- Double maturity benefit

- The risk faced by human lives is —–

- Living too long

- Dying too young

- Illnesses and disabilities

- All of the above

- Which of the following is true?

- Moral hazards are insurable

- Physical hazards are insurable

- Both are true

- None of them are true

- The principle of ——- is unique to life insurance policies

- Uberrima fides

- Offer and agreement

- Consideration

- All of the above

- A man can have valid insurable interest in which of the following –

- His own life

- His wife

- His children

- All of the above

- Assignment is defined under Section —- of the Insurance Act, 1938

- 39

- 38

- 41

- 45

- Death benefit received under a life insurance policy is exempted under Section —- of the Income Tax Act, 1961

- 10 (10A)

- 10 (10D)

- 80C

- 80D

- Insurance advisors should follow which of the following practices?

- Fact-finding of the client

- Objection handling

- Gaining knowledge of financial products

- All of the above

- ULIPs allow which of the following features?

- Premium redirection

- Top-up

- Partial withdrawals

- All of the above

- Suicides are not covered under life insurance plans within –

- One year of policy purchase

- One year of policy revival

- Both of the above

- None of the above

IRDAI exam registration: How to register?

To register for the insurance advisor examination, you would have to enrol with an insurance company whose policies you would like to sell. To enrol, there would be a registration form which you would have to fill. Provide all your details in the form and pay a registration fee. The fee is dynamic and is fixed by the IRDAI. Once the form is filled, you need to pay the IRDA exam fee. Post that, you get registered for the insurance advisor exam.

You would, then, have to undertake an IRDAI prescribed training before you become eligible to sit for the insurance advisor’s exam.

Importance of insurance agent exam

The Insurance Regulatory and Development Authority (IRDAI) has mandated every advisor to be certified before being able to sell insurance. This certification can be obtained only through the insurance advisor’s exam.

The main reason for this examination is to ensure that trained and knowledgeable individuals sell insurance.

Since insurance is a technical concept, knowledge of its technicalities can be possessed only by individuals who have taken a course in insurance study.

The insurance advisor’s exam tests the insurance knowledge acquired by prospective insurance advisors. Only those individuals who clear the test can get their license.

Licensed advisors are in a better position to sell the right insurance product to a client because they have the correct knowledge at their disposal.

Tips to Become a PoSP under the IRDAI guidelines

TurtlemintPro offers a simpler insurance exam which is created by the Insurance Regulatory and Development Authority of India (IRDAI). The exam is held for 100 marks on the guidelines prescribed by the IRDAI. The exam is and is simple. If you crack the exam, you can become a Point of Sale Person (PoSP).

You are also given the required training so that you get the knowledge of the exam syllabus. The syllabus is created as per the guidelines of IRDAI and training is given through online videos which are very easy to understand. Moreover, you can access these videos on the go and don’t have to take any classroom training.

So, you can choose TurtlemintPro and get access to a simpler exam and become a Point of Sale Person (PoSP) for Turtlemint. As a Point of Sale Person (PoSP) you can sell insurance policies of different companies and earn handsomely.

A career in insurance is rewarding and you can choose to become an insurance advisor either with an insurance company or with TurtlemintPro to benefit from insurance sales.

Know about How much will I earn selling insurance?

Frequently Asked Questions (FAQs)

Becoming a certified insurance advisor through TurtlemintPro offers several advantages. You gain the ability to sell a wide range of insurance policies including health, motor, and life insurance across various platforms. TurtlemintPro provides ongoing support, ensures timely payouts, and offers access to comprehensive training and marketing materials. This support structure enhances your effectiveness and success in the insurance industry, making it a rewarding career choice.

The frequency of the IRDAI IC 38 Insurance Advisor Exam varies but typically, it is conducted periodically throughout the year. This scheduling accommodates the demand from aspiring insurance advisors and administrative feasibility, ensuring ample opportunities for individuals to undertake the exam and obtain certification.

To clear the Insurance Advisor Exam and qualify for an advisor’s license, candidates need to achieve a minimum score of 40%. This criterion ensures that certified advisors possess the necessary knowledge and competency to effectively sell insurance products and serve clients.

Yes, the Insurance Advisor Exam, including the IC 38 exam, is conducted online. This mode of examination offers convenience and accessibility, allowing candidates to undertake the test from anywhere with an internet connection. It aligns with modern educational practices and facilitates broader participation in the certification process.